African, Asian and Latin American states have won a vote on tax reform at the UN – it could boost revenues and help them catch stolen cash

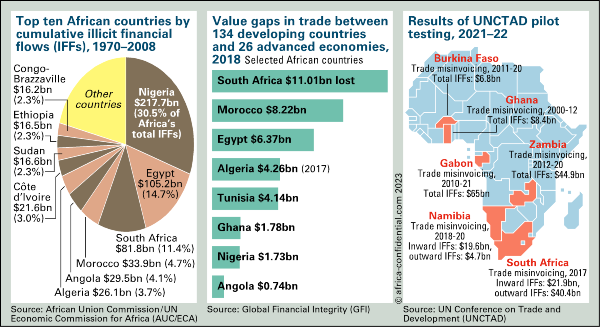

Ahead of the annual meeting of the UN General Assembly, African states were focusing on the need to claw back the billions of dollars lost in illicit financial flows (IFFs) as their treasuries searched for revenue to fund public services and pay spiralling debt service costs. On 22 November, a coalition of 125 mostly developing countries led by Nigeria won a vote in the UN General Assembly to establish an intergovernmental authority to draw up rules on tax and combating IFFs (AC Vol 64 No 21).

READ FOR FREE

A decade-long campaign for global tax rules to be set by a UN authority could finally come to fruition

Years of campaigning to coordinate support from middle-income and developing countries saw the UN General Assembly vote decisively on 22 November to establish a UN tax authority, easily...

From negative-equity Ghana to South Africa with its sizeable gold holdings, emerging markets are scrambling for liquidity

What happens when your central bank starts losing money? Less than you might think, in practical term at least. Ghanaians were horrified to hear their central bank –...